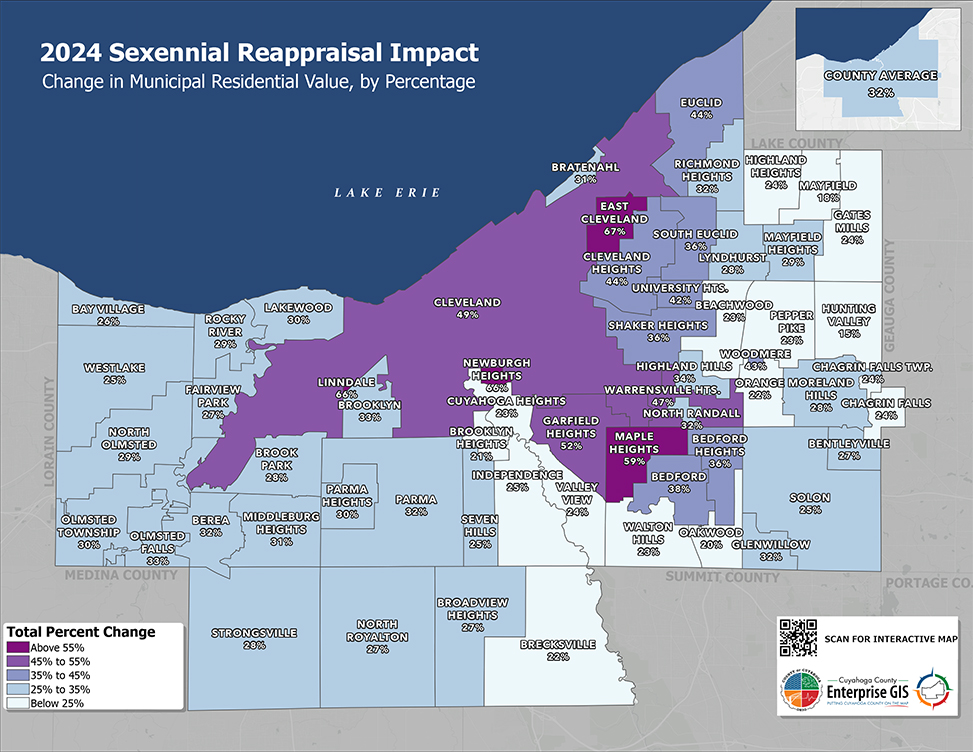

2024 Sexennial Reappraisal

Purpose

Under Ohio State law and Department of Taxation rules, real property is reappraised every six years by state licensed appraisers. An increase in valuation does not mean your property taxes will increase.

Appraisal Process:

An appraisal is a professional opinion/estimate of value.

Property values are updated based on:

- Market estimate

- Neighborhood sales and new construction

- Proposed values per square foot

Info sessions for Formal Tax Complaints

To learn more about how to file a complaint, join our Fiscal Team at one of these informational sessions:

*All sessions are 6 p.m. – 8 p.m.

Wed., Feb. 5

Cuyahoga County Public Library – North Olmsted

24703 Lorain Road

Large Meeting Room

Wed., Feb. 19

Cuyahoga County Public Library – Beachwood

25501 Shaker Boulevard

Auditorium

Wed., March 5

Cuyahoga County Public Library – Parma Powers

6996 Powers Boulevard

Meeting Room A/B

Wed., March 19

Cuyahoga County Public Library – Strongsville

18700 Westwood Drive

Meeting Room

Formal Tax Complaint Process January 1 – March 31, 2025

Residential property owners who want to contest their property valuation may file a Formal Tax Complaint by one of these methods:

- Electronically with a DTE Form 1 through the Cuyahoga County Board of Revision during the complaint filing period

- Via U.S. Mail, email (BORinfo@cuyahogacounty.gov) or fax (216-443-8282)

- Delivered in person to the Board of Revision

Address:

Cuyahoga County Administrative Building

2079 E. 9th Street, 2nd Floor

Cleveland, Ohio 44115

When filing a Formal Tax Complaint the property owner must provide documents to support their opinion of value, which can include:

- A complete appraisal report from the last calendar year

- Dated photographs of the property, showing existing conditions

- Certified estimates from a contractor for repairs

- Purchase agreement with closing statement

- New construction costs certified by a builder (hard and soft costs)

Note: The Board of Revision will schedule a hearing. Property owners must provide evidence to prove their opinion of value.

Questions?

Fiscal Office

216-443-7420, option 3

fiscalquestions@cuyahogacounty.gov

Resources for Residents

- Homestead Exemption - Find out if you are eligible for this tax credit.

- Owner Occupancy Credit - Find out if you are eligible for this tax credit.

- EasyPay - A convenient way to pay property taxes.

- Military Deferment - Property taxes can be deferred.

- Property Alerts - Protect yourself from deed fraud.

An official website of the Cuyahoga County government. Here’s how you know

An official website of the Cuyahoga County government. Here’s how you know